As the super-growth cycle is ending in dramatic fashion, we are already seeing some of the most attractive valuation opportunities in years.

Increasing rates and a sell-off in equities have led to a materially improved opportunity set from our valuation-oriented perspective. Today, the most important question for investors should not be whether to take risk in this environment, it should be where to take it. We believe it’s time to tap investment solutions that exploit value around the globe. At this year’s Fall Conference, we shared some of our highest-conviction, valuation-led ideas.

Explore our content below and Contact Us or your GMO representative for more information. Intended for accredited investors.

Featured Session:

Quality Investing in Interesting Times

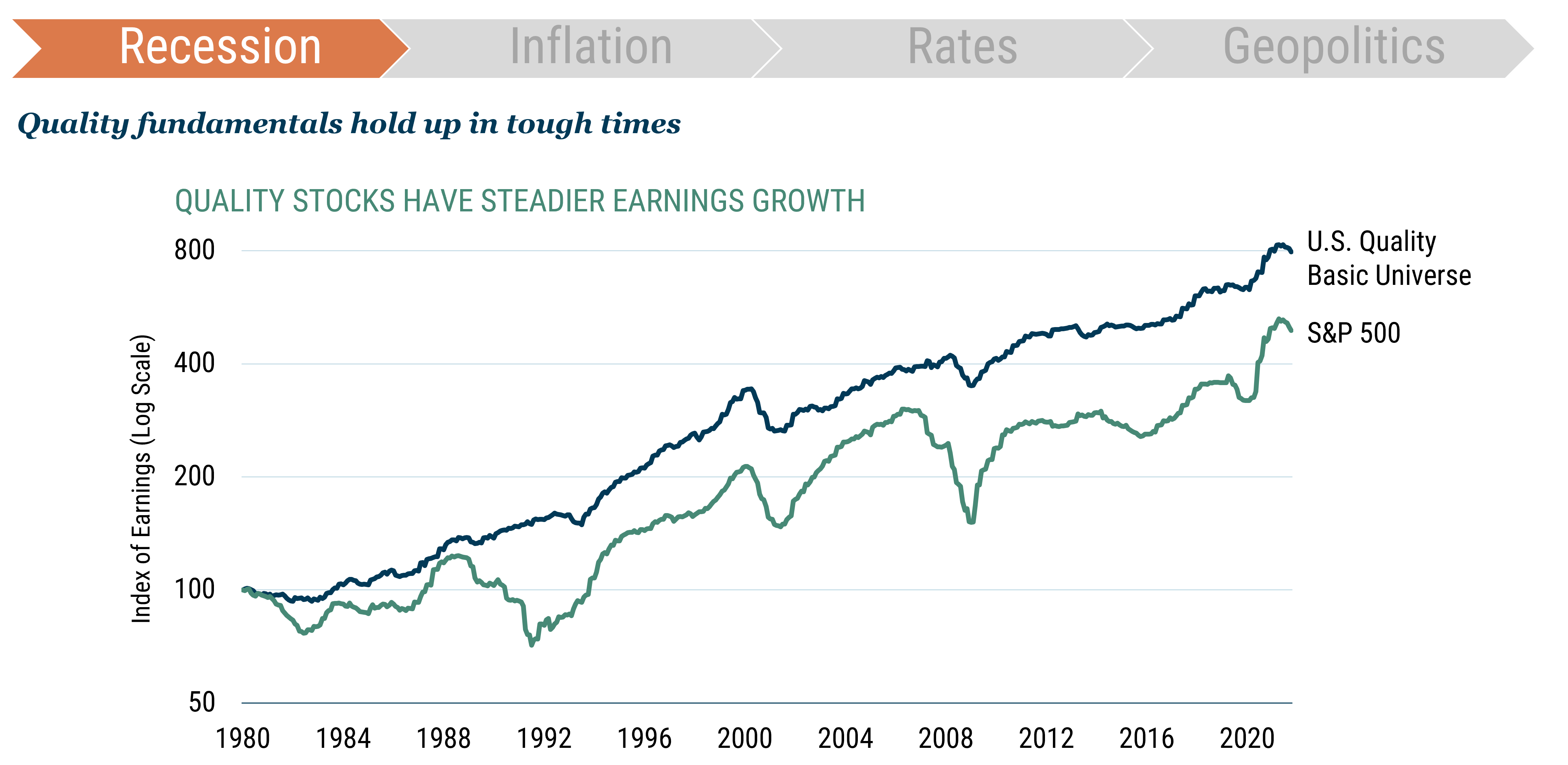

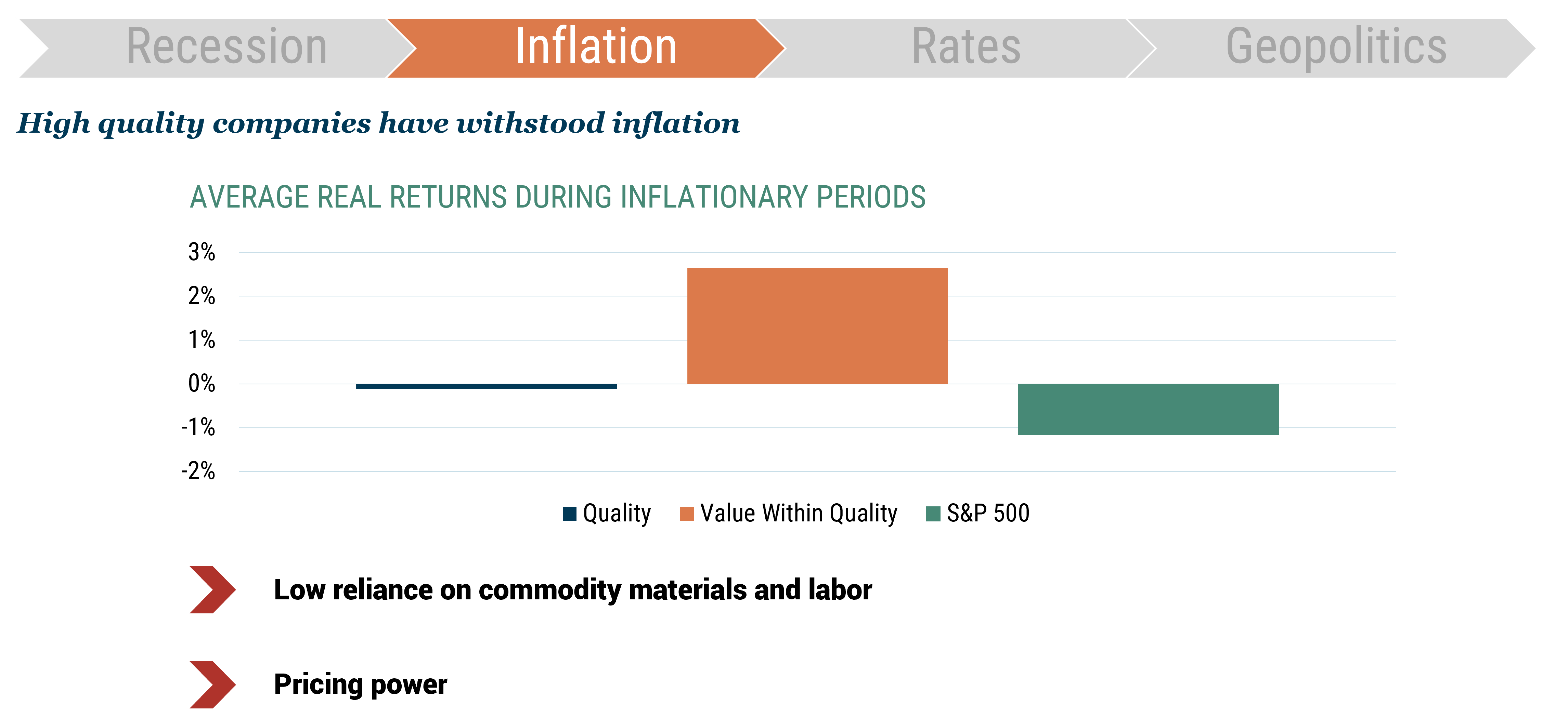

There’s been no shortage of topics to keep things interesting for investors today – a looming recession, inflation, rising rates, geopolitical risks, and Covid (which is still a disrupting force, three years in). Tom Hancock, Lead Portfolio Manager of GMO Quality and Head of the Focused Equity team, and Kim Mayer, Quality Portfolio Strategist, discussed how each of these key issues impacted Quality in 2022 and the markets in general. They also explained what separated successful Quality strategies from the rest in this year’s bear market and why Quality stocks offer protection during both market downturns and inflationary times.

As of 9/30/22 | Source: GMO

The S&P 500 Index is an independently maintained and widely published index comprised of U.S. large capitalization stocks. S&P does not guarantee the accuracy, adequacy, completeness or availability of any data or information and is not responsible for any errors or omissions from the use of such data or information. Reproduction of the data or information in any form is prohibited except with the prior written permission of S&P or its third party licensors.

Quality is the highest quality 1/3 of the market on GMO’s metric blending profitability, stability, and leverage. Value within Quality is the low valuation half of that.

The Case for Small Cap Quality

Attractive short-term valuations and valuable long-term dynamics in small cap quality are finally aligned. Hassan Chowdhry and James Mendelson, Portfolio Managers of GMO’s new Small Cap Quality Strategy, shared why they believe investors can confidently add small cap quality to their equity portfolios despite heightened uncertainty for many risk assets.

(Anti)Trust the Process: How to Generate Uncorrelated (and Positive!) Returns in a Correlated World

Making money in a down market is not easy. In this session, Doug Francis, Sam Klar, and Cole Weppner from GMO’s Event-Driven team demonstrated how their approach to investing in situations with idiosyncratic outcomes can offer strong absolute return potential without dependence on traditional risk premium assets.

Systematic Global Macro: 20 Years of Uncorrelated Returns

Drawing on more than two decades of global macro investing at GMO, Jason Halliwell identified the characteristics that have enabled GMO’s Systematic Global Macro Strategy to flourish in a variety of market environments. Today especially, he sees an attractive outlook for liquid alternatives.

Value’s Attractiveness: How Has It Evolved and How Much Is Left?

Two years ago at GMO’s 2020 Fall Conference, we first highlighted the extraordinary valuation spread between cheap Value and expensive Growth stocks and launched GMO’s Equity Dislocation Strategy to take advantage of this historic opportunity.

At this year’s Fall Conference, Equity Dislocation Portfolio Manager Ben Inker and Carl O’Rourke, a Systematic Equity team quantitative researcher, provided an update on the ongoing attractiveness of Value relative to Growth. Even after Value’s recent significant outperformance, it is nowhere near back to its average relative valuation compared to Growth, which means the opportunity remains quite strong. And even if Value/Growth spreads do not continue to come back to historical averages, the act of rebalancing provides an incredible opportunity at today’s valuations.

Ben and Carl discussed the evolution of Equity Dislocation, which is long the cheapest Value stocks and short the most expensive Growth stocks and still our highest conviction Asset Allocation trade.

Energy Transition Opportunities: Clean, Green, and Obscene

Lucas White, lead Portfolio Manager of GMO’s Climate Change and Resources strategies, outlined what he believes are misunderstandings by the market about continued secular growth in both resources and climate equities. The energy transition is already creating long-term investment opportunities in these sectors, which currently trade at attractive discounts to the market.

Japan: An Active Manager’s Treasure Trove – Using Engagement to Unlock Shareholder Value

Japanese equities look attractive through both top-down and bottom-up lenses. Rick Friedman identified some of the secular and cyclical reasons why GMO likes Japanese Value equities today, while Colin Bekemeyer described the various ways GMO’s Usonian Japan Equity team generates alpha through company engagement.